High Deductible Health Plan (HDHP) Only Health Savings Account (HSA)

ChoicePlus HDHP & Core HDHP Only

PROVIDER: Optum Bank

Contact Information:

www.optumbank.com

+ 1.866.234.8913

Seminar From Moneta, full Heath Savings Webinar:

register.gotowebinar.com/recording/1036568295868519937

- Medical investment account, similar to an IRA

- Employees can elect to set aside money for IRS-eligible health and dental expenses not covered by insurance

- Deductions are made pre-tax (when deposited through payroll)

- HSA utilizes a debit card linked to the employee’s account

- Employees who are enrolled in a High Deductible Health Plan

- Funds roll over from year to year

- You cannot combine an HSA with a medical FSA account

- Receipts must be maintained for IRS purposes

- Significant penalties apply for using funds for non-medical purposes

- ONLINE: www.optumbank.com

- MEMBER SERVICES: 1.866.234.8913

- Duke will provide initial funding based upon benefit election into an OptumBank Health Savings Account

- $500 Individual

- $1,000 Employee + Spouse

- $1,000 Employee + Child(ren)

- $1,500 Family

| HDHP/HSA Seed Money Pro-Rating Schedule Effective 2021 Plan Year) | |

|---|---|

| Q1/Open Enrollment (Enrollments/changes by 3/31) | = 100% |

| Q2 (Enrollments/changes by 6/30) | = 75% |

| Q3 (Enrollments/changes by 9/30) | = 50% |

| Q4 (Enrollments/changes 10/1 or after) | = 25% |

- The Employee can contribute a pre-tax elected amount

- 2024 Employer + Employee contribution limits:

- Individual $4,150

- Family $8,300

- 2024 Employer + Employee contribution limits:

Special note: If you do not already have an account with OptumBank you will need to reach out to them. You will need our group number which is: 76-411376

- An HSA is like no other savings account. Learn More: www.optumbank.com Have a high-deductible health plan? A health savings account (HSA) is designed to help you save and pay for qualified medical expenses. The money goes in tax-free, grows income tax-free and comes out income tax-free when you use it for qualified medical expenses.

- Save money and save on taxes? Yes, please.

- There is no “use it or lose it” rule

- Your contribution amount can be changed at any time.

- It’s a family affair. Funds can be used for anyone you claim on your taxes.

- Invest your HSA dollars

- Update questionnaire after 2023 is completed

- You may not be ready to retire, but chances are you’re already planning for it. Use HSA to prepare for medical expenses in retirement.

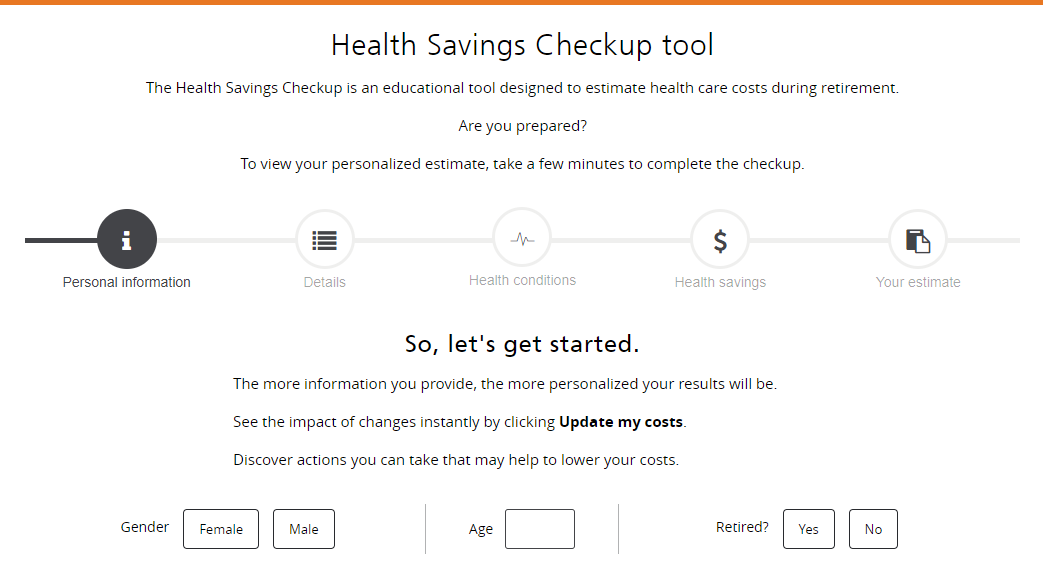

- Help me calculate my benefit.

- Maximum Yearly Contribution, HSA Tax savings, Future Value of your HAS

- HSA investment options

- Qualifying Medical Expenses

- Health Saving Checkup Tool: