Important but often missed!

PRO TIP!

Use one or more of the Voya Voluntary Benefits with the High Deductible Plan to ensure you have a safety net for unforeseen big expenses!

Why High Deductible Health Plan (HDHP) & Health Savings plans (HSA)?

- Lower premiums out of your check

- Non-Tobacco, Family using 2024 Rates

- ChoicePlus PPO vs Choice Plus HDHP = $3197.22 Savings

- Non-Tobacco, Family using 2024 Rates

- Health Savings Plan (HSA):

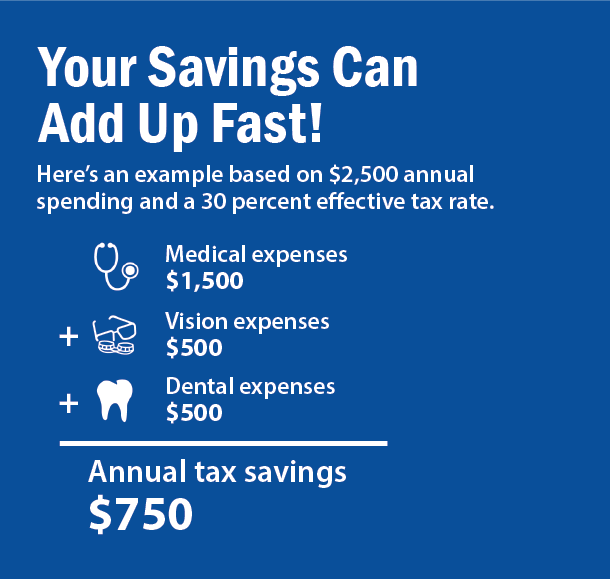

- Save money on taxes by contributing to an HSA

- Example: $2500 at a 30% tax rate = $750 savings

- Follows you if you ever leave Duke or Retire

- Accumulates from year to year (NO use-it-or-lose-it)

- Duke contributes yearly to your account.

- REMINDER: You must create an account with OPTUM bank before we can put money in your account!

- Your biweekly contributions can be changed AT ANY TIME!

- Can be invested!

- Helps prepare for medical expenses in retirement!

- Invest your HSA dollars

- Update your HSA Questionnaire each year

- You may not be ready to retire, but chances are you’re already planning for it. Use HSA to prepare for medical expenses in retirement.

Medical Flexible Spending Account (FSA): Wageworks/Heath Equity

Considering an FSA? FSAs are tax-advantaged accounts that let you use pre-tax dollars to pay for eligible medical expenses. You can use an FSA to save on average 30 percent on healthcare costs

Here are 8 things you need to know

- Take advantage of your “day-one” available balance

- Contributions are tax-free. “Click here” to view contribution limits.

- Your entire annual balance is available on day one

- After annual enrollment, you can only change elections with a “qualifying life event”

- An FSA lets you pay for more than you think. “Click here” to view the THOUSANDS of qualifying products and services.

- You can pay for eligible expenses directly, or get reimbursed later

- FSAs let you pay for your spouse and eligible dependents too

- FSAs are ‘use it or lose it’ accounts

- Duke offers a grace period for the first 2 ½ months of the following year.

Dependent Care Flexible Spending Account – WageWorks/Health Equity

5 Rules (Click to view article)

- Contribution limits apply (Click to view limits)

- Account funds are available only as you make contributions – Click to view Eligible Expenses

- Unused funds return to the plan – “use-it-or-lose-it rules” but have a 2 ½ month grace period into the following year

- Election amounts can only be made during annual enrollment, unless you have a qualifying life event

- Change to employment status for you or your spouse

- The birth or adoption of a child

- Marriage or divorce

- Daycare closure

- Documentation from a babysitter is usually required